The International Monetary Fund warned recently that global economic growth was being crimped by trade tensions and a tit-for-tat over tariffs.

by Lucy Bayly / Oct.10.2018 / 7:21 PM GMT / Updated Oct.10.2018 / 8:53 PM GMT

A trader works on the floor of the New York Stock Exchange (NYSE) in Manhattan in New York on Oct. 10, 2018.Brendan McDermid / Reuters

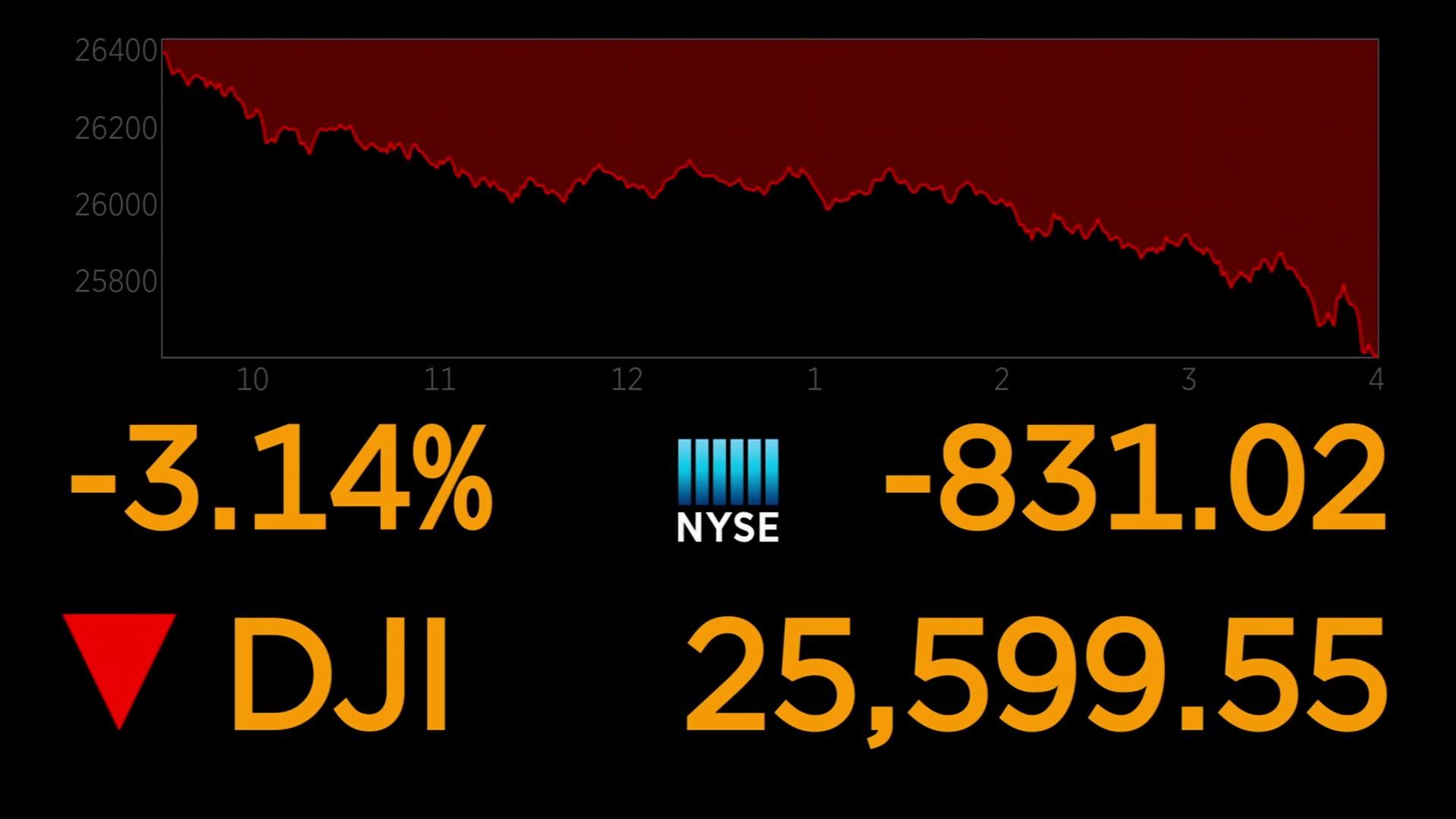

The Dow Jones plummeted by 818 points on Wednesday, closing at 25,608 and marking the worst day for the index since February.

The S&P 500 closed 3.3 percent lower, while the tech-heavy Nasdaq tumbled by 4 percent for its worst day since Brexit. Wall Street's "fear gauge" or volatility index rose to its highest level since April.

Investors were mainly reacting to rising rates and Treasury yields, as well as a recent warning from the International Monetary Fund — essentially the world’s lender of last resort — that global economic growth was being crimped by trade tensions and a tit-for-tat over tariffs.

The Dow Jones plummeted by 818 points on Wednesday, closing at 25,608 and marking the worst day for the index since February.

The S&P 500 closed 3.3 percent lower, while the tech-heavy Nasdaq tumbled by 4 percent for its worst day since Brexit. Wall Street's "fear gauge" or volatility index rose to its highest level since April.

Investors were mainly reacting to rising rates and Treasury yields, as well as a recent warning from the International Monetary Fund — essentially the world’s lender of last resort — that global economic growth was being crimped by trade tensions and a tit-for-tat over tariffs.

“It is a perfect storm for technology right now with the tariff war with China and weaker demand for chips,” Ryan Nauman, market strategist at Informa Financial Intelligence, told Reuters.

The routing knocked $7.5 billion off the personal fortune of Amazon founder and CEO Jeff Bezos, with Warren Buffett taking a $3.5 billion hit, according to Forbes.

"Trade policy reflects politics, and politics remain unsettled in several countries, posing further risks," said Maurice Obstfeld, the IMF’s chief economist, on Tuesday, warning that the world would be a “poorer and more dangerous place” if there were a full-scale trade war between the U.S. and Beijing.

After a nine-year streak of economic expansion and artificially low rates, the Federal Reserve has just begun a series of hikes for its benchmark borrowing rate. Fed chair Jerome Powell approved the latest rate increase on Sept. 26, his third such move since February. When rates go up, investors typically pull money out of the stock market in favor of safer assets and interest-bearing accounts.

After the closing bell, a White House official told reporters: "This is a bull market correction. It is probably healthy, it will probably pass. The economy remains strong."

CORRECTION (Oct. 10, 2018, 4:52 p.m. ET): An earlier version of this article misstated the last time the Dow dropped as much as it did today. It was the Dow's worst day since February 2018, not since August 2016.

No comments:

Post a Comment